“What I found in my life is that most of the things that surprise me were things that never happened in my life before.” - Ray Dalio

Surrounded by a group of friends, I listened as they expressed their thoughts and shared mainstream news snippets on the Russia and Ukraine conflict. The conversation turned to how the Russian advance on Kyiv had stalled and the Russian army appeared to be floundering. During a pause in the conversation, I asked, “Do you think Putin even wants to take Kyiv?” They all laughed in my face and dismissed my question.

That experience, rather than embarrass me, encouraged me because it confirmed I was operating outside of the mainstream media blackhole. It motivated me to dig deeper into the geopolitical and economic history that led to where we are today.

My subsequent reading, listening, and research over the last five weeks focused on the American-led, dollar-centric, world system in place (in one form or another) since the end of WWII. I wanted to learn if the chaos printed in today’s headlines could indicate a change in the global economic system or simply another bump along the same road. My understanding is still rudimentary. I now have more questions than before. But what I learned is fascinating and it makes me more committed to building a resilient life now more than ever.

(Alright! Grab a seat and a drink of choice because you’re about to get flashbacks to Economics 101 class!)

In his phenomenal three books, The Accidental Super Power, The Absent Super Power, and Dis United Nations, the geopolitical analyst, Peter Zeihan, argues that the world has enjoyed seven decades of uncommon peace and economic prosperity due to the United States maintaining a unique world order.

The order was birthed in Brenton Woods, New Hampshire, in 1944, when representatives from forty-four countries met to discuss what the world would look like when the Allies finalized their victory over the Axis powers. The decision was largely dictated by the United States because it was the sole super power, with the most gold reserves, the largest navy, an economy larger than all others combined, and a homeland untouched by war. America held all the cards. But America saw the Cold War on the horizon and even with all of its strength, it realized it needed a system to contain the Soviet Union without deploying millions of troops around the globe. That was the goal of the order America designed.

Compared to the European empires of the past (whose modus operandi was to militarily occupy their empires), the United States set up a different type of system. The American system had four tenets:

Firstly, all the partnering nations were given unlimited access to the American consumer market (the only market at the time untouched by the war). This was an unexpected lifeline to all the war-torn nations whose recovery would have been much harder without access to America’s robust economy.

Secondly, America committed its Navy to protect all trade throughout the globe. The benefits of this to the partnering nations cannot be overstated as it granted them access to any global market they desired without the normal expense of protecting their trade routes.

Thirdly, the US dollar would be accepted as the reserve currency of the world, pegged to gold at a fixed rate, and all other currencies would be pegged to the dollar.

And finally (and the main reason for this plan), the United States would dictate the security policy of the order with the goal of organizing the free world into a united front to contain the Soviet Union. The system in many respects was a smashing success. Zeihan writes:

“Soon after the war, the dual American poles of economic and military alliance were extended to the defeated Axis powers, the counties that would in time become know as the Asian tigers, and the bulk of the developing world up to and including China.

The American-dominated free trade system ushered in the greatest era of peace and prosperity in human history. Global GDP expanded by a factor of ten. The global population tripled. The massive, civilization-threatening wars of the past (whether they be Franco-German, Russian-Turkish, Japanese-Chinese or imperial predation) all simply stopped, held in abeyance by smothering security and wealth of the American network. The Soviet Union never had a chance.'“

What remains of this system today affects our lives in drastic ways; two in particular I want to highlight. The first is the historic amount of economic prosperity still enjoyed across the globe. Yes, America bribed nations to keep them out of the Soviets’ sphere of influence and to contain the Soviets (which it did), but a secondary consequence was a massive boom in prosperity and global peace. (At least relative to the historical average.) At what other time in history did the most powerful nation on earth protect all trade routes for all nations? This protection has allowed global economies of scale as each nation was able to focus on their economic strengths and safely access their most advantageous markets. Historically, this was a privilege enjoyed by only the most powerful nations or empires. Instead of wars being normal, trade became normal. And the currency in which those trades are transacted is the second drastic way our modern lives are still affected by the order America designed.

Since the beginning of the Brenton Woods system, the US dollar has been the global reserve currency; which means other nations hold their reserves (aka savings accounts, and rainy-day funds) in US dollars instead of gold or another currency. So just like you save in dollars, so do the governments of England, and France, and Japan; among many others. To maintain this status, originally, the US dollar was stabilized by backing it with, and fixing its value to, a set amount of gold. That agreement was broken when President Nixon “took the US off the gold standard” in 1972. Even with that break of faith, the US dollar is considered the most stable fiat currency and still is held as reserves by many countries.

In addition to this, dollar is the currency of choice, and in some cases the only option, for the majority of global trade transactions. For example, in 1974, Saudi Arabia agreed to price all their oil sales in dollars, and the rest of OPEC, and the world followed suit.

(You guys still with me?! Perhaps you should get up, shake out your legs and grab another drink…of water, of course!)

These two functions of the US dollar (reserve currency and currency of global trade) have created a system where other nations need US dollars to operate in the economic order. This in turn has created what’s been termed the United State’s “exorbitant privilege.” That is, that the United States is able to print dollars to fund its wars, social programs and projects, with little consequence because other nations have willingly filled their reserves with those printed dollars. Other countries produce goods and resources and sell them to the United States and in return receive dollars. America’s greatest export for many decades now has been the dollar.

Although we may not realize it, we and our parents have existed within a historical anomaly. For more than seventy years, the world, and particularly the United States, has prospered within a system that was designed to contain the Soviet Union. But many years have passed since the Berlin Wall fell. This begs the question, how long can a system outlast it’s original goal?

Because of recency bias, it’s hard for us to comprehend a world where each nation must defend its trade against competing or belligerent nations, or one where the dollar isn’t the global reserve currency. With a bit of thought, a few challenges come to mind.

Without American-guaranteed global trade, globalization would decline and many of the goods and services Americans use wouldn’t be available or would be vastly more expensive. In short, the standard of living would decrease. Consider a few examples of how this global system reaches into daily American life: Each major part of every iPhone is made in a different manufacturing plant scattered throughout nearly a dozen different countries. Much of the food eaten throughout the US is produced and shipped from Central and South America. Twenty percent of American electricity is produced via nuclear plants which use uranium, half of which comes from Russia, Uzbekistan, and Kazakhstan. Unfortunately, the “just-in-time” supply chains and next-day delivery may not be the most consequential casualty of a global economic change.

The consequences if the US dollar were to lose its global reserve status could be felt on a personal level as well. If the dollar were not the reserve currency of choice, the world would require fewer dollars. If the rest of the world absorbs fewer dollars, the United States couldn’t print billions (as it did in 2008) or trillions (as it did in 2020-2021) in response to crises. That is unless massive inflation is the goal. The loss of reserve status could create inflation of a whole new magnitude. There was a saying in Weimar Germany during its massive inflation, “don’t leave your wheel barrow that full of money outside, someone might steal the wheel barrow.”

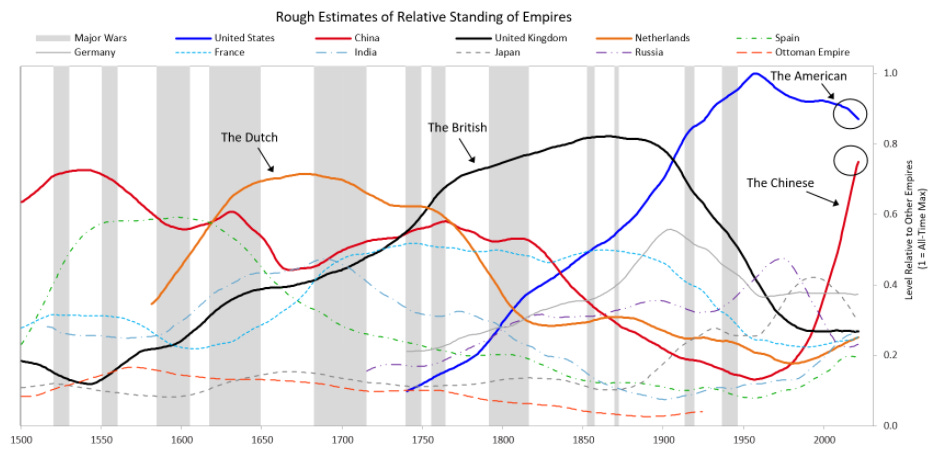

Through these weeks of in-depth study, I was reminded of Ray Dalio’s research that we talked about in an article back in February. In particular the image below came to mind:

The graph attempts to illustrate that America’s relative standing on the global stage could be waning. Dalio argues this is largely due to the waning dominance of the US dollar (this was also a leading factor for the other empires charted). The graph also clearly shows the unusually long break since the world has experienced a major war. This prompts many questions: Is the US about to lose its position of dominance? Is the world going to cycle into a new global order, or anti-order? Is the US dollar about to be replaced? Are we due for a major war? Answers to these questions can’t be known, and certainly can’t be accurately graphed. But I think it’s important for all of us to have a basic understanding of the precarious economic position we are living through because it can have deep impacts on our lives. I don’t want any of us caught off guard and unprepared.

My response to this uncertainty is summed up in what I wrote back in February:

“Even if America bucks the trend and retains its prominent position, it’s unlikely to do so without a challenge. So if history repeats, or at least rhymes, those of us in the United States (and the world) could be in for a turbulent couple decades; far different than what we or our parents have experienced.

Because we’ve lived peacefully in the dominate world power, luxury and ease are the norm. As a result, the average American leads a life very dependent on others and the government - a very non-resilient life. A surprise in just one area of their lives - the loss of a job, bare grocery shelves, an extended electrical outage, a breakdown in global trade - is enough to create total chaos.”

As I said at the beginning of this article, what I’m learning and what I know of current happenings, motivate to me to build a resilient life for my family. I’d be a fool to assume that the uncommon prosperity and peace will continue unabated. And with a multigenerational mindset, not only do I want to live free and resiliently, I want the same for my kids and their kids. If times and systems are ready for a change and reboot, my goal is to prepare my family to be able to handle the change and to thrive.

Now get out there are courageously live an unsafe, but good life.

If you found this article educational, please do me a HUGE favor by simply clicking the LIKE button. A one second investment of your time can pay dividends to the work I’m to doing with The Intrepid Life!

Share this post