“Krupp and Stinnes get rid of their debts, we of our savings.” - Klaus Mann (1923)

Hugo Stinnes earned the nickname “Inflation King” when he became the richest man in Germany in the 1920’s. How Hugo rose to that position is a tale both fascinating and educational.

Born in Germany in 1870, Hugo inherited and ran his family’s coal business during WWI and the hard times that followed it. Although well-off because of his successful business, it was the massive inflation during the years following the war that vaulted Hugo to the position that earned him his nickname.

After WWI, as a result of the Treaty of Versailles, Germany was burdened with massive debts that forced it to pay back the costs of the war to the other affected nations. Unable to pay the debts in any other way, the German government resorted to printing their national currency, the reichsmark, to make their payments. This led to massive inflation of the currency supply and a shocking reduction in the currency’s purchasing power against other currencies, gold, commodities, hard assets and goods.

Either by chance or exceptional foresight, Hugo took advantage of this catastrophe by borrowing huge loans in the German paper currency prior to its hyperinflation. With these loans Hugo bought ships and coal mines and made other investments into hard assets for his business. He borrowed so much, in fact, that it seemed ludicrous at the time. But when inflation of the reichsmark skyrocketed in 1921-1923, Hugo was able to pay back those loans with nearly worthless currency and he was left owning all those hard assets.

A simple example may help us understand how this process worked. Let’s say you take out a mortgage for $1 million and with it you buy a rental apartment. To keep it simple, your hypothetical monthly payment is $2,000 and your tenant initially pays you $2,000 per month in rent. Pretty cool so far…your tenant is paying your mortgage. At that rate, after thirty years you’ll fully own an apartment that someone else paid for. That’s a pretty sweet deal. Now let’s see what happens when inflation comes into the picture.

Say the government prints trillions of dollars in a couple year span and the amount of goods and services doesn’t increase. In this case, prices will adjust higher. In our example, you are providing a service - shelter - and what you charge for monthly rent will necessarily increase. This is because, although you still provide the same service, it takes more dollars to compensate you because each dollar is worth less than before. Keeping it simple, let’s say the price increases one hundred percent so you now charge $4,000 per month. With a fixed rate mortgage, your monthly payment will remain approximately $2,000. And because you still only have to repay $1 million you can pay it off in half the time - in fifteen years.

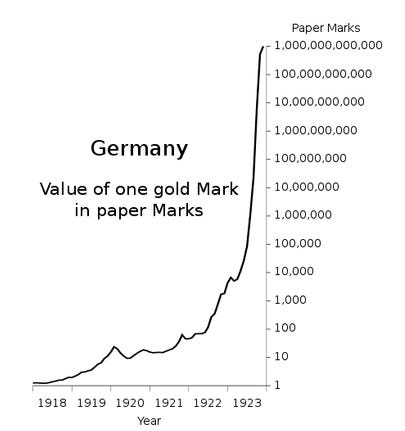

While paying off a mortgage in half the time simply because of inflation may sound dramatic, it pales in comparison to what actually happened in Weimar Germany. The graph above shows the dramatic decrease in purchasing power of the German paper Mark compared to gold. What cost one paper Mark in 1918, cost one trillion paper Marks by the end of 1923.

The book, “When Money Dies,” by Adam Furgusson, provides some numbers that illustrate the mind-blowing increase in prices during Weimar Germany’s hyperinflation. The price of one egg increased 180-fold between 1914 and mid 1922. To put that in perspective, since the average price of a dozen eggs today is $1.79, it would be similar if in 2030 the same dozen eggs costs $322. Another example is that a liter of milk increased from seven Marks to twenty-six Marks over a six-month period in 1922. That’s the type of inflation Hugo and all his countrymen experienced.

Now let’s apply Weimar-Germany-style hyperinflation to our simple example to get a better feel for what Hugo experienced. If the rent you charge simply kept up with the rate that a liter of milk increased in 1922, after one year, instead of charging $2,000 rent, you would be charging $15,000 rent per month. At that rate, you would be able to pay off your $1 million mortgage in five and a half years. That’s how Hugo leveraged his way to owning massive amounts of real assets and becoming the richest man in Germany.

The opposite side of the coin is just as instructive. For every Hugo in Weimar Germany there were thousands of people who suffered tremendously. Imagine what happened to people who’s income didn’t keep pace with the rise of the cost of goods and services. As the price of milk increased 7.5 times in a single year, the average Joe and Jane probably had to spend all their income and savings just to survive.

Let’s put it in today’s terms. Imagine, you have savings of $1 million. Today that can buy you 250,000 gallons of whole milk at the national average price of $4.00 per gallon. How would your life change if next year the same gallon of milk cost $30? Your savings of $1 million could then only buy you 33,000 gallons of milk. That’s how inflation destroys purchasing power and reduces the standard of living. As we can see, Weimar Germany’s inflation impacted people very differently depending on how they were financially positioned. This explains what Klaus Mann’s quote at the beginning of the article spoke of - “Krupp and Stinnes get rid of their debts, we of our savings.” Apparently Mr. Mann wasn’t positioned to thrive off of inflation.

Although it’s less obvious, the same dynamics are currently at play now. The only difference today is that inflation is destroying our purchasing power and lowering our standard of living at a slower rate.

I wrote about today’s inflation back in January in the article “Inflation is Stealing Your Time.” I talked about possible consequences of high inflation and how if your income doesn’t keep up with the increase of inflation you will become increasingly poorer. I tried to show how inflation is a tax on your time and on your purchasing power.

Much like the government of Weimar Germany, today’s governments around the globe are burdened with massive debt obligations. The options for paying off the debt (or at this point just making payments) include increasing taxes, or decreasing spending, or defaulting. Or they can print money and inflate the debts away. What path do you think they’ll choose?

I believe the path of least resistance is to pay those debts with increasingly worthless currency. With a façade of benevolence, governments can print money and hand out stimulus checks while at the same time destroying purchasing power. They can appear to be helping while actually making the situation far worse. To those unaware of inflation’s true destructive nature it appears great to just get a couple extra grand in the mail. The fact of the matter is, with purchasing power destruction everyone loses, except for those who get to buy votes to maintain their position of power.

To be fair, no one can know if inflation is here to stay, or if it will get worse than it is right now. But I believe the odds and incentives are in inflation’s favor. If that’s the case, what do we do? For us Joes and Janes, I don’t suggest you take out massive loans like Hugo Stinnes, but I do suggest you educate yourself on how to defend your purchasing power against the ravages of inflation. Gone are the days where life savings are safe in bonds or a simple savings account. Like Stinnes, a good place to start is owning real assets that can’t be printed or manipulated and that can increase in value at or above the rate of inflation. The goal shouldn’t be to become the next king of inflation, is simply to remain a freethinking, sovereign individuals.

As always, the only financial advice The Intrepid Life will ever give is: don’t fall in love with money. Instead know how to use it effectively as a tool to protect and provide for those you love.

Now get out there and courageously live an unsafe, but good life.

If you found this article educational, please do me a HUGE favor by simply clicking the LIKE button. That one second investment of your time can pay dividends to the work I’m to doing with The Intrepid Life!

Announcement!

Early in my journey of writing The Intrepid Life, I listened to a podcast, about podcasting, where the host cited a statistic to the effect that if as a podcaster you make it to your twenty-first podcast you would be in the top five percent of podcasters. Well, I know The Intrepid Life didn’t start out as a podcast, but that number twenty-one stuck in my brain and right then I committed to writing at least twenty-one newsletter articles.

Friends, this is article twenty-one! It really feels great to have reached this milestone. Even if its an arbitrary milestone that I set for myself.

At the same time, I've used this milestone as a point of reflection and I’ve concluded that I will transition to sending out only 2 articles per month, one every other Saturday.

I am making this change for two reasons: 1) so I have extra time for some investment business ventures I am working on, and also 2) so I have the needed time to take each The Intrepid Life article to a higher level. I’m really excited about the road ahead. Thank you all for your continued support!

Share this post