A Worldwide Game of Jenga

The stage is set for a dramatic inflection point in geopolitics; with consequences for every individual.

“The swinging of conditions from one extreme to another in a cycle is the norm, not the exception.” - Ray Dalio

With sky-rocketing inflation and economic shutdowns, polarizing presidential elections and protests, and threats of internal and international war, the last two years have been a constant barrage of worrying headlines. These days, our world seems to teeter like a late-stage jenga tower, poised to topple.

During such times, one wonders if it’s always been this insane. Some argue today simply appears more turbulent because every generation reminisces over simpler times, or because the internet gives a front page to every crisis. At the same time, there are some who argue it’s a result of converging multi-generational cycles.

One particular cycle is the shifting of geopolitical dominance. Unfortunately, if this is in fact occurring, the stage is set for more turbulence than we, or our parents, have experienced. To grasp where we stand today, and to successfully navigate possible upheaval, an understanding of similar historical periods is necessary.

Another time rife with worldwide chaos was 2008-2009 during the Great Financial Crisis. The global banking system lost $500 billion and approached total collapse. In that environment, the famous investor Ray Dalio, successfully grew his clients’ portfolios by an astonishing 8.7 percent. In subsequent interviews, Dalio credits his understanding of history as what enabled him to predict the financial crisis and protect his clients. He said:

“What I found in my life is that most of the things that surprise me were things that never happened in my life before. That taught me I need to study past history. Studying the Great Depression allowed me to anticipate the Great Financial Crisis.”

Today, Dalio sees another crisis emerging. In his latest book, Principles for Dealing with the Changing World Order, Dalio shares what he learned from studying the predictable cycles nations have followed over the last five hundred years. What caught my attention was Dalio’s ability to list, and visually graph, macro issues that are so big they’re hard to see on an individual level.

Dalio claims there are three unprecedented issues with the current state of America: 1) the amount of debt and debt monetization, 2) the magnitude of internal conflict due to wealth and value gaps within the population, 3) the rising of a great power (China) to challenge the existing great power (United States).

Because they are unprecedented in our lifetimes, he warns these issues could produce surprising consequences for unaware and unprepared Americans.

Dalio argues the US is in an environment unique in its history, but an environment all historical major powers eventually enter. He says major powers follow a predictable cycle: prosperity leading to over consumption and debt, followed by debt implosion and loss of their dominant position. The United States began this cycle post WWII when it emerged from the war as the unmatched global power.

The United States’ position as the military and economic super power over the last 75 years produced immense prosperity. That prosperity led to enormous debt accumulation. (The US debt now exceeds $30 trillion.) Because the US has a central bank that can “print” currency to pay off government loans, this created a perverse spiral of ever-increasing debt.

This spiral is a leading factor in Dalio’s second observation - internal conflict due to wealth and value gaps within the population. The result of massive currency printing is asset price increases and currency devaluation. Because the wealthy tend to own assets and the poor tend live on cash, this process leads to the rich becoming richer, and the poor becoming poorer. The image below shows the percentage of wealth and income of the bottom 90% of Americans is at its lowest level since WWII.

The solutions to income inequality vary widely with political beliefs. The riots of the Black Lives Matter movement and the hatred displayed during recent election cycles are examples of this growing division.

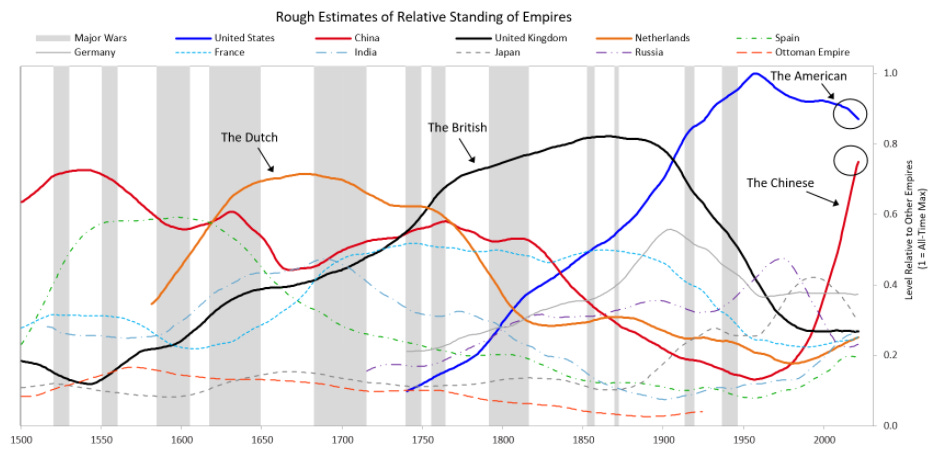

The rising of a great power to challenge the existing great power is Dalio’s final unprecedented issue. Immense debt and internal conflict can lead to the decline of the world dominant power. That decline creates a vacuum which is quickly filled. The chart below shows the relative “strengths and weaknesses of the leading world powers since 1500.” Note the unusually long absence of a major war since WWII, as well as the direction of the American and Chinese trend lines.

Dalio’s observations convince me we are living during an inflection point in history. The question of whether America will retain its top position on the world stage will be answered.

The point of this article isn’t to warn of certain war with China, or the inevitability of a debt implosion, or of irreparable cultural divides. None of these are certainties. Personally, I hesitate to bet against the American spirit and ingenuity. But because, “history doesn’t repeat, but it does rhyme,” we’d be unwise to ignore these patterns and their consequences.

One lesson we should take away is the importance of studying history. It’s hard to find a great thinker or leader who isn’t an avid reader and student of history. (Studying history is one of The Intrepid Life’s tenets of critical thinking.) If you aspire to care for yourself and lead your family well, don’t be caught off guard by things that are unprecedented in your lifetime, but have happened time and time again throughout history.

Even if America bucks the trend and retains its prominent position, it’s unlikely to do so without a challenge. So if history repeats, or at least rhymes, those of us in the United States (and the world) could be in for a turbulent couple decades; far different than what we or our parents have experienced.

Because we’ve lived peacefully in the dominate world power, luxury and ease are the norm. As a result, the average American leads a life very dependent on others and the government - a very non-resilient life. A surprise in just one area of their lives - the loss of a job, bare grocery shelves, an extended electrical outage, a breakdown in global trade - is enough to create total chaos.

One of my observations is that the majority of Americans are more concerned about daily Tweets of celebrities than about building resilient lives. Another observation is that, during a crisis, the majority of Americans are willing to relinquish their freedoms to anyone promising to keep them safe.

Lastly, I’ve observed another group of Americans willing to proactively protect freedom for themselves and future generations. At The Intrepid Life you’re in good company.

Now get out there and live a courageously unsafe, but good life.

Thanks for sharing your great thoughts - keep it up! Cheers, skitch.substack.com